This file type includes high resolution graphics and schematics when applicable.

The electronic components industry’s largest players expect another slow-growth year, though they say the outlook calls for an improvement over 2015. Customer demand for the newest technology—in products, services, and in their online business experience—is driving the need for more technical expertise and a solutions-based selling approach that has authorized and independent distributors alike focused on delivering better service levels across the board. These are just some of the insights unveiled in Global Purchasing’s 2016 Top Electronic Components Distributors report.

Avnet’s efforts to address the converging technology issues are evident in the executive-level changes the company has made in the last six months alone. In December, the distributor announced the newly created role of chief information security officer (CISO), naming Sean Valcamp to the post. Valcamp is responsible for Avnet’s global IT security as well as enterprise architecture and strategic planning for IT. The company followed up with a January announcement that Ed Smith, president of Avnet Electronics Marketing Americas, will lead the company’s embedded solutions business worldwide as senior vice president, global embedded business, effective this July. Also in January, Avnet created its first executive-level Internet of Things position, hiring Eric Williams as vice president of IoT. Williams will work across Avnet’s technology, embedded, and electronic components businesses to develop a global IoT strategy.

Commenting on the latter position in particular, Fay emphasized the importance of a company-wide, global approach to technology issues.

“For the first time in history, we’ve hired an executive to drive a business strategy across the business,” explains Fay. “And we will continue to grow that.”

Other top distributors are focused on similar demands, especially as they relate to services.

“The overall makeup of our operations group is different today than it was 10 years ago in terms of the skills and talents we’re looking for,” says Mark Bollinger, vice president of marketing for Houston-based independent distributor N.F. Smith and Associates, which ranks 13th in this year’s report, with sales of $516.2 million. He explains that N.F. Smith has hired more technically proficient employees in recent years and has dedicated more space in its Houston headquarters facility for component testing and services—all in response to changing customer demands.

Top Distributors, By the Numbers

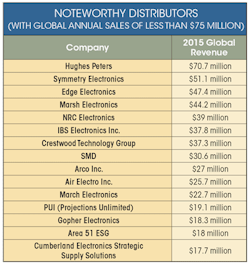

This year’s Top Electronic Components Distributors report highlights 27 companies serving customers in North America and around the world, with sales of more than $75 million. It also recognizes a handful of noteworthy U.S.-based firms with sales of less than $75 million, which also serve customers across North America and around the world. Twenty of the companies in this year’s report cited a sales increase in 2015 compared to figures they provided last year—an average 6% increase. Three companies reported flat sales, and 16 reported a decline in year-over-year sales—an average 7% drop. (Year-over-year figures were not available for three of the companies in our list). Looking ahead, most distributors in the electronic components channel are predicting another modest year in 2016.

“We’re building a little better momentum coming off 2015,” says Michael Knight, senior vice president, Americas, for distributor TTI Inc., No. 6 on this year’s list with $1.95 billion in sales. “Last year ended on a disappointing note. It started hot and finished cold. I wouldn’t say this year is starting hot, but medium-warm—which is a lot better than cold.”

North America continues to be soft, with better conditions reported in Europe and Asia, distributors agree.

“In North America, it will be another one of those years—not good enough to throw a party, but not bad enough for a wake. Something in between,” says Knight. “We continue to see good things happening in Europe…the weaker euro is helping everyone.”

He says he expects to see slower growth in Asia due to the slower global economy and slowing conditions in China, especially.

Minnesota-based global distributor Digi-Key Electronics, No. 8 on this year’s list with $1.7 billion in sales, reported strong growth in China in 2015, pointing to recent investments the company has made in the region, including infrastructure, an expanded product offering, ongoing development of design tools, and localized customer service and currency options. The distributor opened its first location in China in late 2013 and began doing business in local currency there at around the same time. Company leaders say they will continue to expand their product breadth to meet customer demand.

“Our core strength is the number of components we have in stock and available for immediate shipment, with access to over [4 million components] via our website,” said Dave Doherty, Digi-Key’s president and COO, in a statement earlier this year citing the firm’s growth in China.

For independent distributors such as N.F. Smith, 2016 is shaping up to be an improvement over 2015 as well. Smith saw a 30% drop in annual sales in 2015, which Bollinger attributes to the nature of the firm’s business serving open-market needs.

“We don’t look at 2015 as a bad year, just as a year with a very different mix of components that were in demand,” Bollinger explains. “For independent distributors, that’s generally the case. It’s difficult for our revenue numbers to match up year to year, because we’re dealing with the open market—with whatever is in demand.

“When I look at 2015, it was not a banner year from a revenue perspective, but we still experienced growth in our global footprint,” Bollinger adds, pointing to the opening of the company’s Bangalore, India, office.

“So far this year we’re seeing a not terribly exciting market; it’s not bad, but it’s pretty flat. There are certainly some bright spots. Automotive is very active for us; there is a lot of excitement in that market. Obviously, anything cloud-based is pretty robust right now.”

Knight says he sees the automotive market as a continued bright spot as well, driven by demand for new features and electronic enhancements on both the commercial and passenger sides of the equation. Medical markets and commercial aerospace continue to perform well, too, he says, adding that the proliferation of electronics across all aspects of life continues to bode well for the electronic components supply channel.

“Conditions have been flat for, [say], 10 years, so it’s easy to start to thinking that it’s going to be this way always,” says Knight. “I don’t believe that. There is so much going on in technology that, once it’s realized, it will spur growth.”

Sensors embedded in everything from health and wellness devices to smart-city applications are likely to produce widespread demand for new products and the replacement of outdated ones, for example.

“There is going to be a wave of products that have really interesting and new features that will add value in our businesses, our lives, and we will start buying them,” Knight explains. “I think before I’m done in this business we will see at least one, maybe two more surges, when it feels like things are on fire. It won’t be this year or next year…but it could be in the early 2020s that we’ll see something. There is just too much really interesting stuff going on in technology [to not expect that].”

Services are a growing opportunity across the board as well, and one Bollinger says independents are beginning to home in on. “An interesting thing for independents right now is that there is an increasing amount of supply chain service business,” he explains. “We’re seeing more supply chain service opportunities—managing inventory, logistics, supporting warranty, and repair-type work. We’re working on cost-savings opportunities and using the market to bring down the average cost of inventory.”

Top Distributors Report: Methodology

Global Purchasing is proud to publish its sixth annual Top Electronics Distributors report, compiled from nomination forms submitted during February and March of this year. Each company in our list is ranked according to its total global sales volume, and all figures are reported in U.S. dollars. We used self-reported data from each company and verified the information against annual reports and earnings statements, where possible, as well as in follow-up interviews with some of the companies at the top of the list.

Figures for Avnet Inc., ranked first, and Arrow Electronics, ranked second, include the sale of computer products, which comprise large segments of each company’s business. The ranking for privately held Future Electronics, fourth, is based on a Global Purchasing estimate.

Figures for Allied Electronics, seventh, reflect its worldwide sales as part of UK-based Electrocomponents plc, which also operates RS Components in Europe. The figure here is a company-provided estimate for global sales for the year ended March 31, 2016. Likewise, sales for ninth-ranked Newark element14 reflect worldwide sales as part of its parent company, Britain-based Premier Farnell, for the year ended Jan. 31, 2016.

For this year’s report, we have highlighted 41 of the largest authorized and independent distributors serving customers in North America and around the world. We broke our list into two segments, those with $75 million or more in annual sales, and those with less than $75 million in sales. The top portion represents the largest companies doing business in the market today, while the bottom portion represents noteworthy U.S.-based companies serving customers primarily in North America.

Our goal is to provide a look at the largest electronic components distributors serving manufacturing customers around the world. We will compile information for next year’s report early in 2017 and we welcome your input. Send your comments to [email protected].

Looking for parts? Go to SourceESB.

This file type includes high resolution graphics and schematics when applicable.