“Wait until next year,” is a slogan often used by baseball teams that failed to have winning seasons. However, it is also a phrase that that could offer some solace to memory chip buyers who have seen steep price increases for DRAM this year.

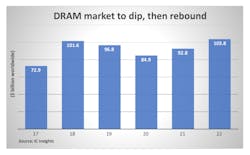

Average prices for DRAM are rising, and will finish 2018 increasing 38% after rising 81% in 2017, according to researcher IC Insights. The good news for DRAM buyers is that capacity is being added and will ramp up later this year and in 2019—resulting in more supply and falling prices.

The added capacity coupled with little growth in unit demand will result in “DRAM transitioning very quickly from shortage to oversupply,” said Jim Handy, general director and semiconductor analyst at research firm Objective-Analysis based in Los Gatos, Calif. DRAM prices will fall as a result, although there is a difference of opinion on how much.

“Prices are going to collapse by 68%,” said Handy. The average price per gigabyte for DRAM will fall from $7.07 in 2018 to $2.57, he said.

However, other researchers forecast more modest price declines. The average price of DRAM will fall 6% next year and 14% in 2020, according to IC Insights.

Handy said the major DRAM manufacturers—Samsung, SK Hynix and Micron—actually began adding capacity last year and have boosted capital spending and continue to increase production capacity this year. “However, it usually takes about two years from the time they commit to add capacity to when new capacity hits full production volume,” he explained. So that means there will be more capacity coming online toward the end of this year and in 2019.

Not all new capacity will be due to DRAM manufacturers building new production lines or fabs. DRAM supply will also increase because of the transition occurring with NAND flash memory, said Handy. Memory IC manufacturers build both DRAM and NAND flash.

Memory chipmakers are transitioning from planar NAND to 3D NAND because 3D NAND has the potential to offer higher capacity in a smaller space. It will lower the cost per gigabyte, cut power consumption, improve reliability, and provide higher data write performance, according to memory IC suppliers.

The ramp up of 3D NAND was slow, but manufacturers have “overcome obstacles and 3D DRAM is now ramping to the kind of production volumes that they were expecting,” said Handy.

Production lines that used to make planar NAND will either be shut down “or converted to something else,” he added. “That something else most likely will be DRAM. It is easy to transition from planar NAND to DRAM. It only takes a couple weeks.”

The good news for DRAM buyers is that while DRAM supply will increase in late 2018 and in 2019, unit demand will not increase much. Unit demand will increase about 3% this year, according to Susie Inouye, research director and founder of Databeans, based in Reno, Nev. She said demand should be similar in 2019 as well. That means the market will no longer be undersupplied. In fact, supply should outpace demand in 2019.

DRAM demand has traditionally been driven by PCs, including desktops and portable computers. However, sales of PCs are sluggish and much of DRAM demand now is being driven by servers for cloud computing that run graphics, video, and artificial intelligence applications, said Brian Matas, vice president of market research for IC Insights, based in Scottsdale, Ariz. Such servers require large amounts of memory. “Companies that are using the servers—the Amazons, the eBays, the Facebooks the big data centers, and others—are willing to pay for the servers and the memory,” he notes, adding that they are not concerned about the price.

“Another big application is cell phones, because cell phones are starting to be crammed with a lot of DRAM for some of the same reasons as servers—that is, artificial intelligence and the 3D gaming applications,” Matas added.

Despite demand from server and cell phone manufacturers, the DRAM market should be oversupplied in 2019. The other good news for DRAM buyers is that there could be more competition in the DRAM industry in the next several years.

Several Chinese companies were expecting to begin trial production of DRAMs in the second half of this year, according to Taiwan-based memory industry researcher DRAMeXchange. However, buyers will have to wait until next year before production volumes of DRAMs are produced by Chinese manufacturers.