Those waiting for an uptick in the growth pace of the U.S. manufacturing economy may want to settle in for a bit of a longer ride. Six years after the Great Recession, global economic growth is still sluggish, and researchers at the Manufacturers’ Alliance for Productivity and Innovation (MAPI) say the conditions will continue to hinder improvements in the United States.

“China's slowdown, thankfully not a hard landing, has been more protracted than many expected,” Cliff Waldman, director of economic studies for MAPI, reported in a recent MAPI Foundation Global Outlook. "The recent data from the Eurozone, while a bit stronger, are being pushed into the background amidst the seemingly endless effort to resolve the Greek debt crisis. The Latin American economy has lapsed into a sluggish malaise with the emerging realization that fundamental reforms will be necessary if the region is to ever achieve sustainable prosperity."

Despite the tough global outlook, the U.S. manufacturing economy has remained a relatively healthy player, according to Waldman—and leading economic indicators attest to that. The Institute for Supply Management’s Manufacturing Report on Business, for instance, has remained positive, with the group’s Purchasing Manager’s Index maintaining a reading above 50—which indicates an expanding U.S. manufacturing economy—since December 2012.

However, Waldman argues that persistent sub-par growth around the world combined with a strong dollar and low oil prices will provide enough of a headwind to keep the U.S. manufacturing economy from achieving strong and stable growth over the short term. That means the manufacturing supply channel can expect the cautious optimism that has prevailed in recent years to continue.

The Global Purchasing Index, which gauges economic optimism among procurement professionals in the manufacturing channel, has reflected that cautiousness over the last six months. In December, the GPI dipped below 100 for the first time since its launch in January 2014; a reading below 100 indicates that buyers have a pessimistic economic outlook. The GPI rebounded in January—to a reading of 117.6—but despite remaining in positive territory has fluctuated since, rising as high as 124.4 in March and as low as 109.3 in April.

The GPI hit a three-month high in June, registering 116, as buyers reported stable business conditions.

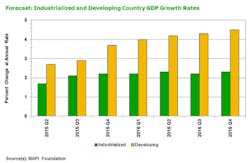

Globally, the outlook remains dim. MAPI reports that aggregate GDP growth in non-U.S. industrialized countries is expected to be just 2.3% by the fourth quarter of 2016, well below the 3% to 3.5% that is normal in a period of global expansion. What’s more, developing country growth is expected to reach just 4.5% in the same timeframe—also below the normal range of 5% to 5.5%, MAPI said.

"With subpar non-U.S. global growth and global deflation jitters likely to persist through 2015 and at least part of 2016, the strong dollar/low oil price combination will frame world economic developments over the short term," Waldman predicted. "For the time being, global challenges will remain a headwind to strong and stable U.S. manufacturing growth."