Distributors serving the burgeoning consumer electronics market still have their eyes on the growing demand for smart phones and similar gadgets as consumers worldwide seek to get more from their mobile devices—and the real money is on apps and the advanced technology needed to make mobile devices do even more in the years ahead.

A technology shift from hardware toward features and applications is driving much of the change in the smart-phone market, as the devices are increasingly used for non-communication functions, according to the Consumer Electronics Association. Attendees at last month’s International CES in Las Vegas noted similar trends, pointing to growing demand for more features in everything from smart phones to tablet PCs.

“Tablet and smart-phone demand remains strong, particularly as price reductions attract new consumers,” says Todd Traylor, vice president of global trading for N.F. Smith and Associates, an independent distributor based in Houston. “Beyond the expanding competition for tablets, ‘phablets’ [phone/tablet hybrids], and smart phones, [the International CES] reveals how the feature envelope is being pushed to both unify and expand users’ mobile experiences.”

And that comes down to the software and electronic components used to power the gadgets. On the components side, Traylor and others point to the growing use of sensors in consumer electronics as one example.

“Devices like smart phones are making increasing use of sensors that allow the digitization of everyday things,” according to a recent report from industry analyst IHS iSuppli, which released an update on consumer electronics trends during last month’s CES. “Specific types of applications mentioned included infrared, near-field communications, and moisture sensors that tell users when their plants need to be watered.”

Traylor points to new capabilities from integrated sensor hubs.

“Notably, there are many examples at CES of increased capabilities for devices connecting via wireless sensors over the latest 802.11ac Wi-Fi standard and Bluetooth,” he says. “Perhaps the most prolific merging of sensors, power management, and wireless chips is the wireless charging that seems to be sweeping CES this year.”

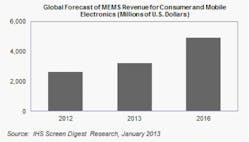

Others point to microelectromechanical systems (MEMS) as a key growth category. MEMS commonly serve as sensors in smart-phone applications, including gyroscopes, accelerometers, and pressure sensors. Global revenue for MEMS in consumer and mobile applications is expected to reach $3.2 billion this year, up more than 20% from $2.6 billion in 2012. Revenue will reach nearly $5 billion by 2016, IHS said (Fig. 1).

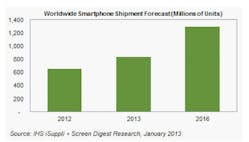

Analysts expect similar growth patterns in smart phones and smart-phone apps this year (Fig. 2). IHS predicts global smart-phone shipments will rise nearly 30% in 2013, a slowdown from the 35% growth seen last year and the more than 60% growth in 2011, but nonetheless a significant figure: 2013 marks the first year smart-phone shipments represent more than 50% of cell-phone shipments worldwide.

Furthermore, global smart-phone application store revenue is set to more than double between 2012 and 2016 after more than doubling in 2011. IHS expects worldwide app store revenue to climb nearly 50% in 2013 to reach about $8 billion.

1. The global market for MEMS technologies designed for mobile electronics will approach $5 billion by 2016. (courtesy of IHS Screen Digest Research, January 2103)

2. Worldwide smart-phone shipments will rise from 2012’s 600 million total to surpass 1.2 billion in 2016. (courtesy of IHS iSuppli + Screen Digest Research, January 2013)