Industrial markets continue to perform well for electronics distributors, especially in North America where some say pent-up demand for capital spending projects is soon to be realized. Distributors serving maintenance and repair-focused customers in particular –especially those looking for electro-mechanical and industrial automation solutions—are looking for mid- to high-single-digit growth in 2014.

Allied Electronics is one such distributor. Company president Scott McLendon says he expects to see 8% top-line growth in fiscal year 2015, following Allied’s 5% growth in fiscal 2014, which ended in March. He points to growth in new markets such as Mexico as a potential bright spot in the industrial economy over the next few years. Allied serves manufacturing customers in Mexico, primarily fulfilling maintenance, repair and operations needs to a variety of industrial segments. The distributor plans to expand its business with oil and gas, automotive and mining customers in the region, for instance.

McLendon also says he sees the market for capital equipment purchases in North America coming back after a lull last year.

“People have been putting off capital purchases for a while,” he says. “Eventually, they have to buy it.”

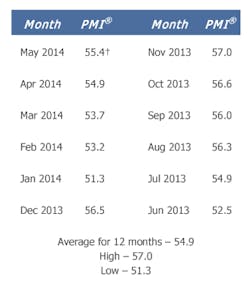

Economic indicators point to industrial strength, as well. The Purchasing Manager’s Index (PMI), a measure of business optimism among supply managers in manufacturing organizations, grew for the 12th consecutive month in May, increasing to 55.4 over April’s reading of 54.9. Purchasing and supply managers surveyed for the monthly report said that new orders, employment and production continue to grow, and they also noted that 17 of the 18 manufacturing segments surveyed for the report indicated growth during the month. No industries reported contraction.

PMI survey respondents also noted that inventories continue to grow and that supplier deliveries are slowing.

Taking a closer look at the electronics supply chain, purchasing and supply managers surveyed for Global Purchasing’s monthly Global Purchasing Index continue to report business optimism as well. The GPI has remained above the 100-point mark indicating a positive outlook among electronics industry purchasing professionals since its launch in January. The GPI measures purchasing professionals’ business confidence in five areas: new orders from customers; electronic component inventory levels; purchasing activity; pricing; and lead times.

Purchasing professionals interviewed for May’s GPI agree with McLendon’s sentiments about pent-up demand for new projects and spending.

“It’s a go. I feel there is currently a push to get lots of projects completed in the ‘now’ time frame” one GPI panelist said.

Electronics distributors focused on original equipment manufacturing (OEM) and contract manufacturing (CM) markets are optimistic as well. Mike McGuire, of connector specialist Astrex Electronics, agrees that some of the “holding back” that occurred in 2013 is beginning to ease, as business conditions picked up for Astrex in the early part of 2014. McGuire pointed to February, March and May as good months for the niche distributor of specialized, high-reliability connector solutions.

“We will probably see the most growth in non-defense-related industries [this year],” says McGuire, pointing to industrial customers in particular and noting that Astrex aims to increase business in the oil and gas segment of the industrial market in 2014.

Leaders at electronic components distributor TTI, Inc., which serves industrial, defense, aerospace, and commercial manufacturers worldwide, are cautiously optimistic about the near-term future. Michael Knight, senior vice president, TTI Americas, said in May that leading economic indicators pointed to an “okay second half of the year,” and that the industry is prepared for more market growth beginning in mid-2015.

“Certainly in North America we are in lockstep with the overall economy,” Knight said, adding that he expects the electronics industry to “roll into 2015 with some good momentum.”

Purchasing Managers Index, May 2013-May 2014

Manufacturing economy continued to expand in May, according to the Institute for Supply Management